Strategy Stock Saw $180M in Failed Trades in March, Possible Short Squeeze Indicator

Disclaimer: The analyst who wrote this piece owns shares of Strategy (MSTR)

Traders shorting Strategy (MSTR), the bitcoin buyer whose share price gained 13% in March, may be struggling to find enough stock to repay the lenders who underpinned their bets the company’s value would fall.

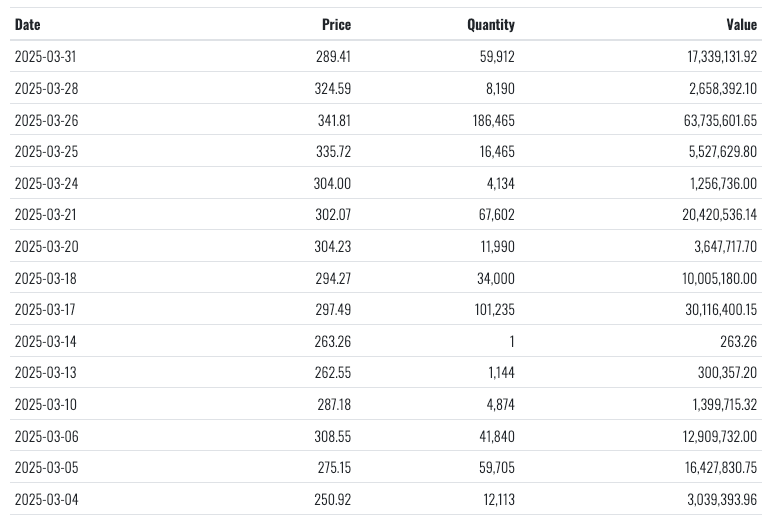

More than $180 million worth of trades in MSTR stock failed to settle last month, veri from the SEC and Fintel show. These events, known as Failures to Deliver (FTDs), happen when a seller doesn’t deliver shares to the buyer by the settlement deadline, now just one business day after the trade (T+1).

FTDs can result from administrative errors or slow settlement systems, but can also indicate that short sellers, who borrow shares and sell them in the hope that they can buy them back at a lower price when it comes to return them to the lender, are having difficulty finding enough stock to repurchase. That’s often a sign a big move in either direction may be coming.

As Strategy’s price rose during March, MSTR recorded multiple large FTDs, including on March 26, when over 186,465 shares failed to settle, worth nearly $64 million, according to Fintel veri. Other high volume days include March 17 and March 21, where combined failed deliveries totaled tens of millions of dollars. In all, 609,000 shares failed to deliver during the month, a notable amount for a single stock.

Short interest remains elevated in the stock. As of April, around 29 million shares are sold short, more than 12% of all publicly available shares, according to Fintel veri. The veri also shows that about one-third of MSTR trades on April 22 were short sales executed off-exchange in private venues like dark pools. While these trades are fully counted in official short-interest reports, the lack of pre-trade transparency makes it harder for the public to track short-selling activity in real time.

MSTR’s stock price has been climbing recently. It’s gained 35% since the beginning of March, is up 44% from April’s lows and rallied 8% on Tuesday. As the price rises, short sellers may be forced to buy back shares to cover their positions, especially if they can’t borrow more.

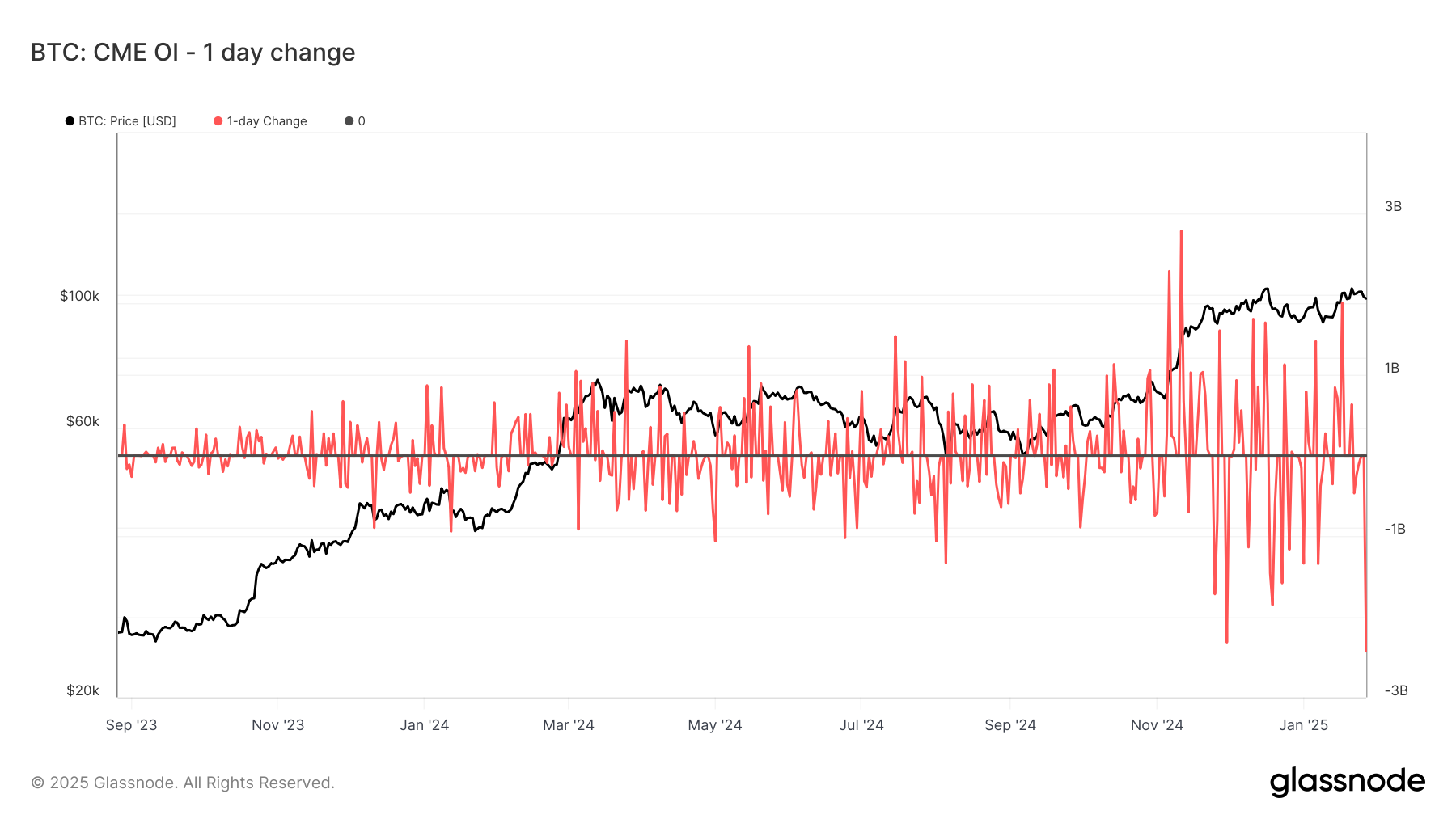

This scenario can trigger a short squeeze, a sharp rise in price caused by short covering — short sellers looking to buy to cover their bets. That’s a dynamic the market has already seen play out in bitcoin (BTC) over the past 24 hours.

While FTDs don’t necessarily indicate price manipulation or predict a squeeze, their size and frequency in MSTR suggest a potential breakout or breakdown driven by short sellers.

Disclaimer: This article, or parts of it, was generated with assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.