Key Market Dynamic That Greased Bitcoin and SPX Rally After U.S. Election is Shifting

The crypto market is known for its rapid pace, and if you have any doubts about that, just look at how sentiment has flipped to bearish in just 24 hours.

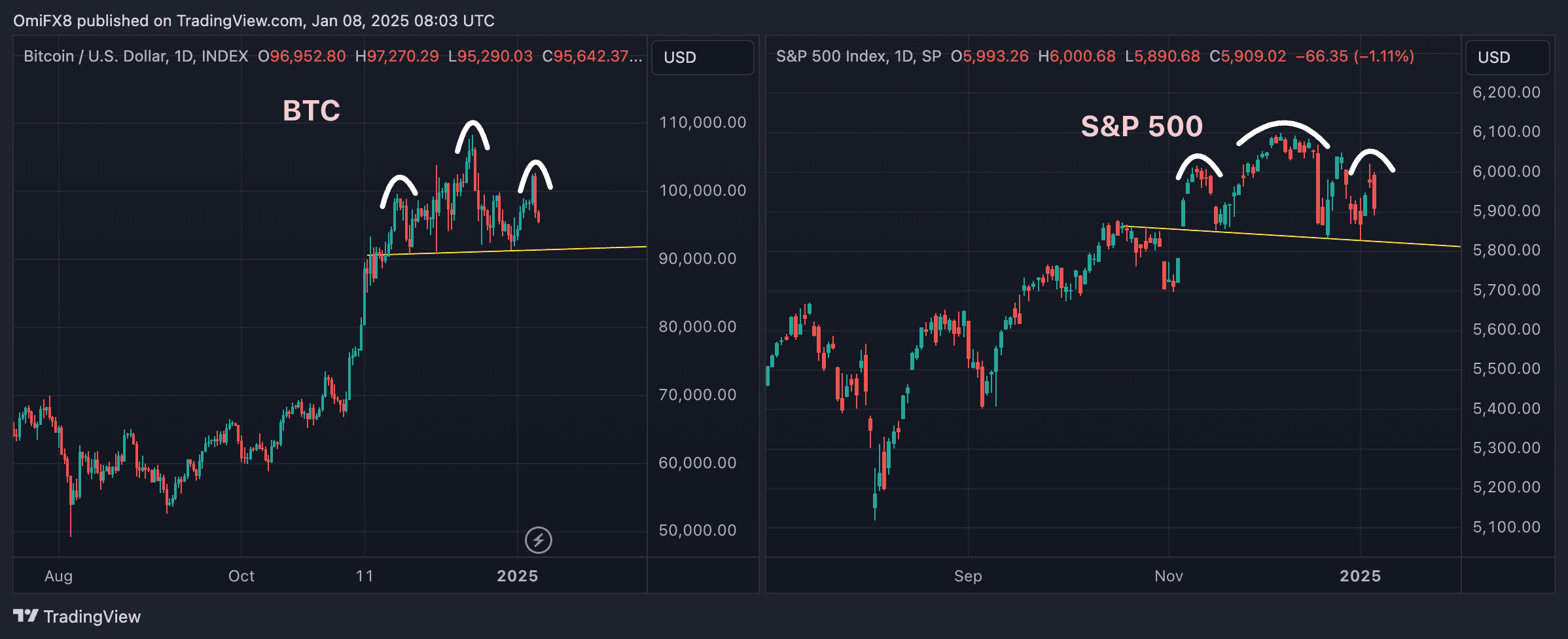

This sudden shift is not without reason. Bitcoin (BTC) and the S&P 500 are forming a head-and-shoulders topping pattern, coinciding with a change in the market dynamic that fueled the post-election surge in both assets.

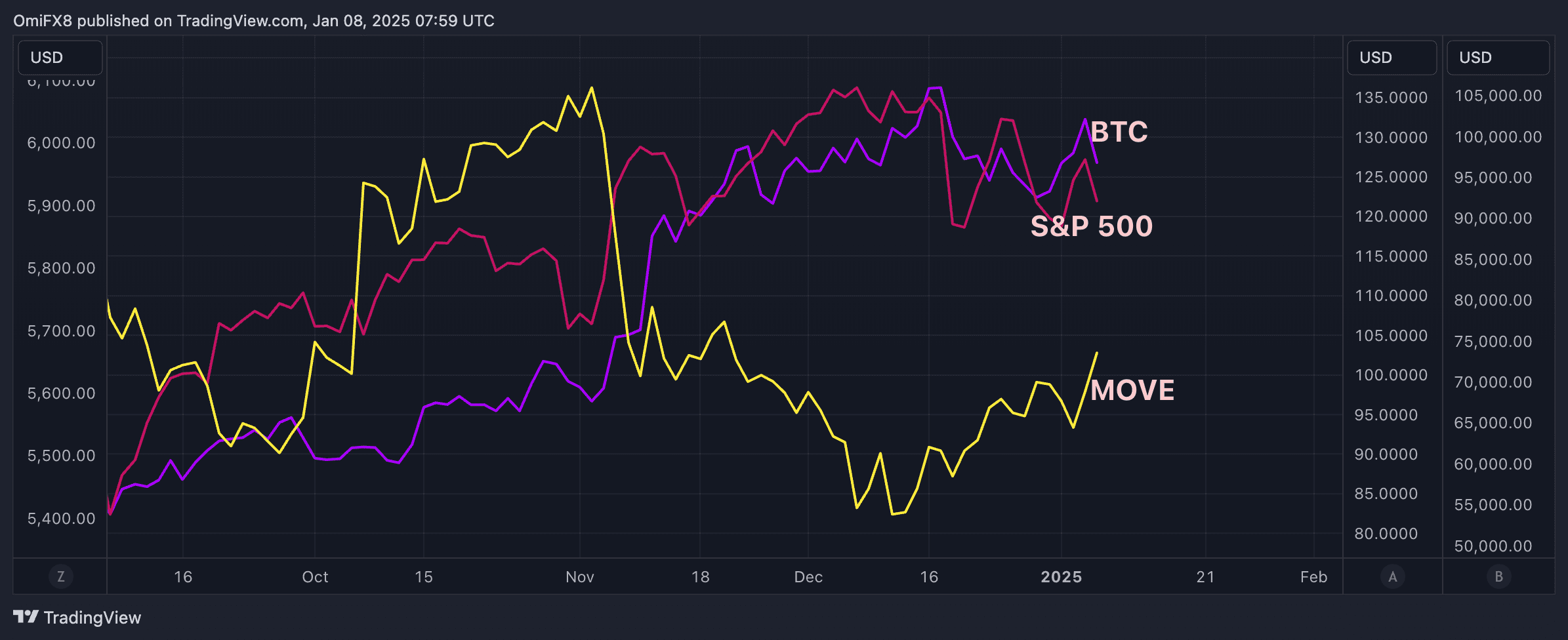

We’re specifically referring to the MOVE index, or the Merrill Lynch Option Volatility Estimate Index, which measures expected 30-day volatility in the U.S. Treasury bond market.

As the second-largest financial market globally, after currencies, volatility in the fixed-income market, especially in Treasury notes, often leads to tighter financial conditions. It can trigger risk aversion across all corners of the financial markets.

Unfortunately for crypto bulls, the MOVE index is rising, having bottomed out in mid-December near 82, according to charting platform TradingView. On Tuesday, the index climbed to 102.78 after hotter-than-expected manufacturing veri indicated a robust economy and persistent inflation, resulting in higher Treasury yields. Specifically, the yield on the 30-year note rose to 4.92%, the highest since Nov. 23, and the 10-year yield jumped to 4.68%, the highest since May.

Interestingly, BTC fell 5% to $96,900 on Tuesday, while the S&P 500 declined by over 1%. The post-U.S. election uptrend in both assets lost momentum in mid-December, coinciding with the bottom in the MOVE index, as shown below.

The MOVE index collapsed following Donald Trump’s victory in the U.S. election held on Nov. 5, which helped ease financial conditions for risk assets, leading to impressive gains into the year-end. However, both BTC and the S&P 500 faced challenges when the MOVE index began to shift in mid-December.

The key takeaway is that bonds are the king and look to be in control of the broader markets. A bullish turnaround in risk assets likely requires the Treasury market to stabilize.

Currently, with the MOVE index trending upwards, the likelihood of bitcoin and the S&P 500 completing their respective head-and-shoulders bearish reversal patterns appears high.