Ether Heads Toward Set of Mammoth $340M On-Chain Liquidations

Ether’s (ETH) 11.5% slide over the past 24 hours has moved the second-largest cryptocurrency closer to a series of mammoth $340 million liquidations on collateralized debt platform MakerDAO.

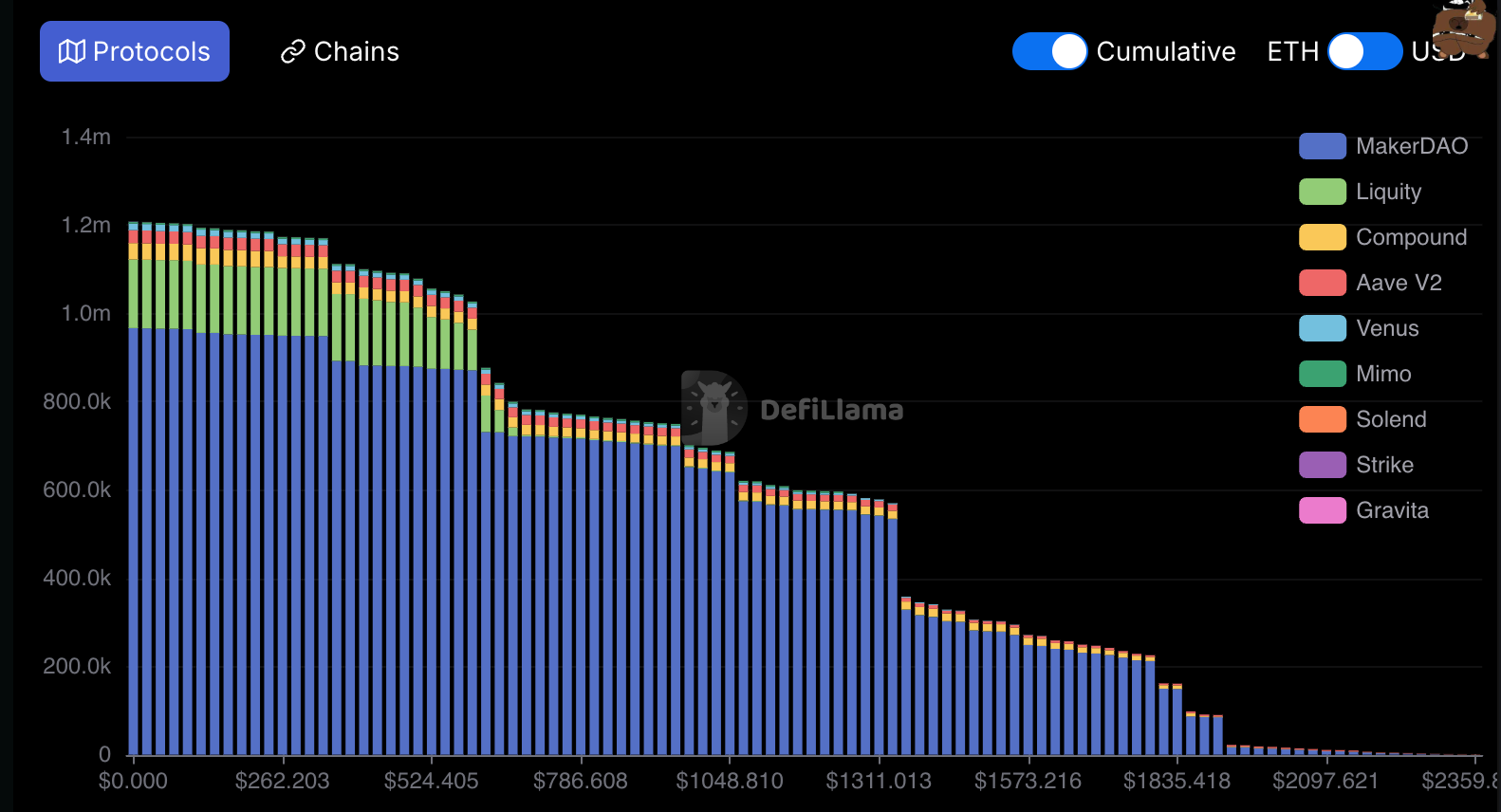

On-chain veri shows three MakerDAO positions will be liquidated when the ETH price hits $1,926, $1,842 and $1,793. Each position is worth between $109 million and $126 million.

Ether, the token of the Ethereum blockchain, is trading around $2,390 following a market-wide sell-off sparked by waning sentiment and a drop in küresel equities.

Whether the plunge is the trigger for a bear market remains to be seen. Assets have typically slumped as much as 30% in previous bull markets to shake out over-leverage before moving back to the upside, ETH is down by 42% since Dec. 16.

In order to trigger the MakerDAO liquidations, ETH needs to fall by another 19%, at which point it could spark a liquidation cascade across decentralized finance (DeFi) protocols and exchanges.

Over the past 24 hours $296 million worth of ETH positions have already been liquidated on exchanges, according to CoinGlass.

It’s worth noting that deleveraging events spurred by sell-offs can present an opportunity for savvy traders to purchase undervalued assets, as the spot price is determined by a short-term lack of liquidity and not what might be considered the true value.