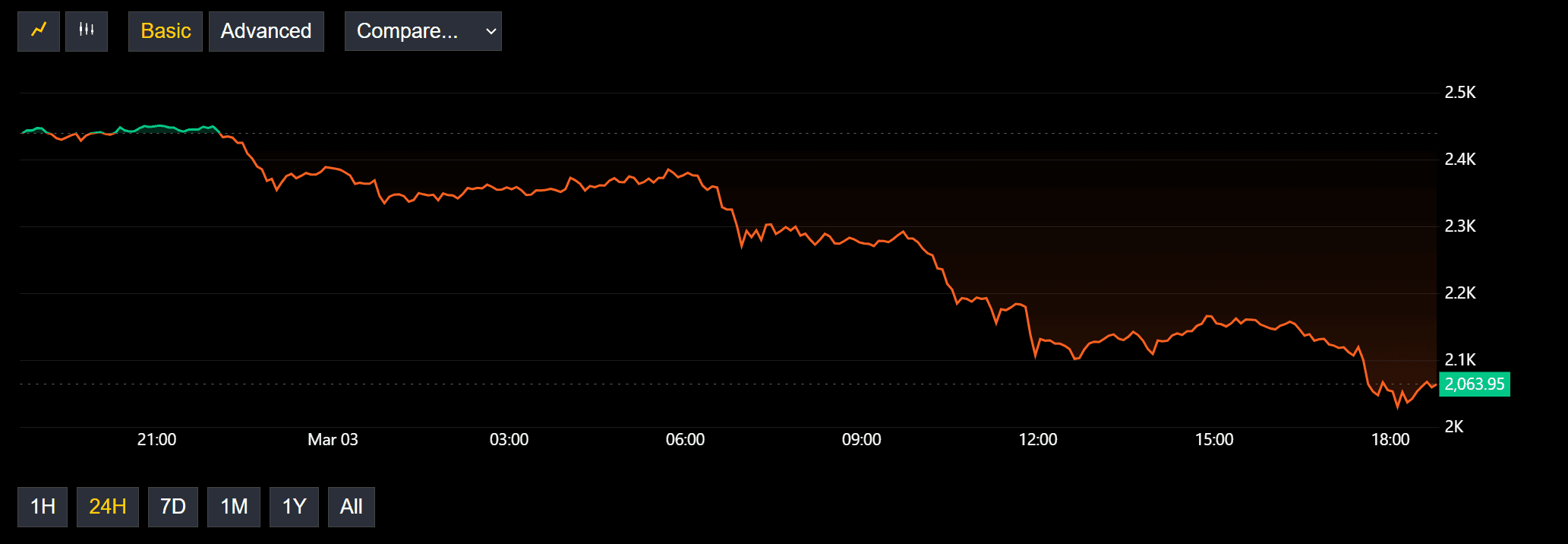

ETH Tests $2K, Lowest Since November 2023

Ether (ETH) is testing levels not seen since November 2023, as the market continues to be hit by volatility resulting from U.S. President Donald Trump’s trade war threat.

ETH is down 15% in the last 24 hours, according to CoinDesk Indices veri, dragging down the CoinDesk 20, a measure of the largest digital assets, which is down 16%.

Ether’s decline over the past three months has been driven by bearish investor sentiment, reflected in its underperformance relative to BTC and weak institutional demand, alongside macro headwinds like trade war fears, inflation concerns, and stock market weakness, which have dampened risk appetite.

CoinGlass veri shows that nearly $165 million in ETH long positions have been liquidated in the last 12 hours.

Bettors on Polymarket are giving a 76% chance of ether hitting $1900 by the end of the month.

Ether ETF outflow was deep in the red last week, according to veri from SoSoValue, coming it at -$335 million.