XRP Hitting $5 Gets Millions in Bets But There Is a Catch

Payments-focused cryptocurrency XRP peaked at $3.40 in January but has since dropped 30% to $2.40.

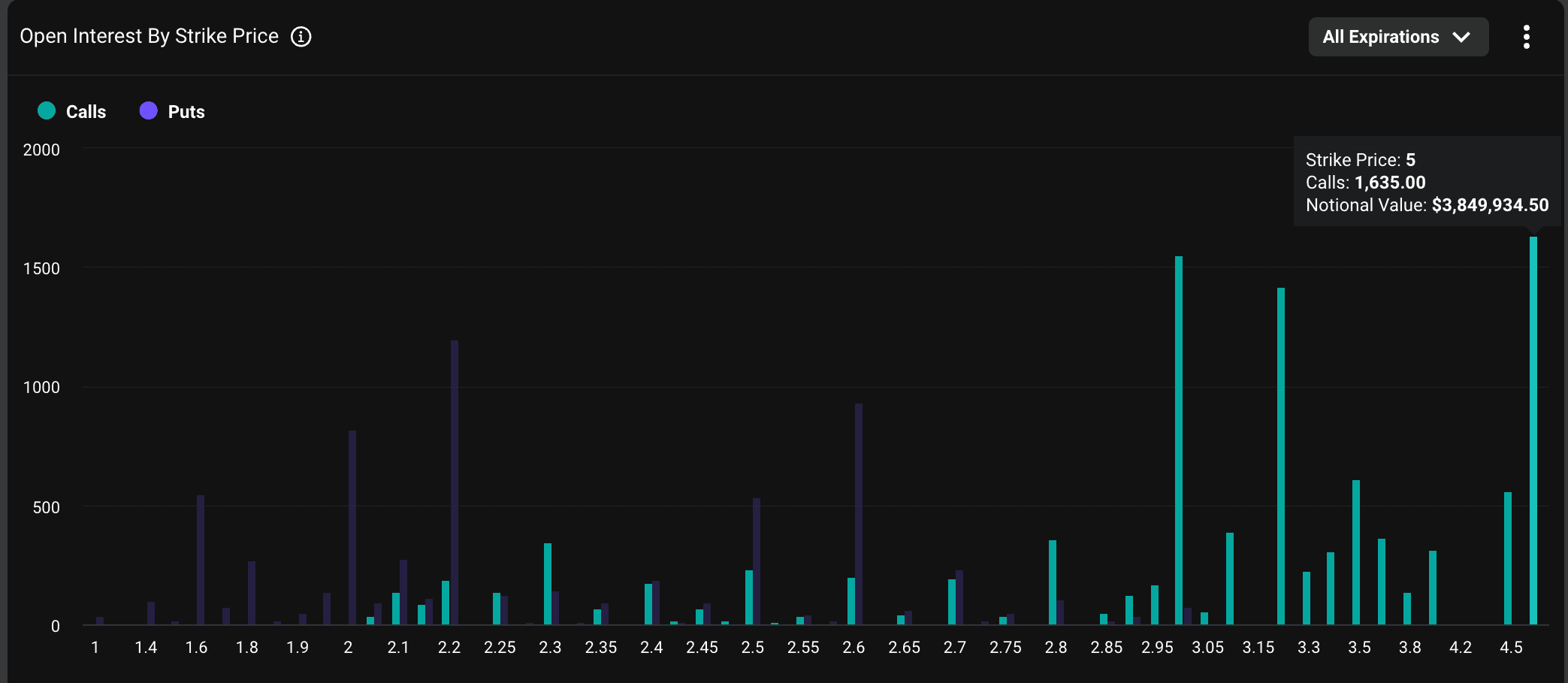

Despite this decline, the $5 call option remains the most favored bet on Deribit, offering significant upside potential for buyers if the price exceeds that level. However, this does not necessarily indicate an outright bullish positioning among traders.

At press time, the $5 call is the most popular strike, with a notional open interest of $3.84 million—the highest among all XRP strikes on the exchange, according to veri source Deribit Metrics. Notional open interest reflects the dollar value of all active options contracts at any given time. On Deribit, one options contract represents one XRP.

“Most of these are covered calls,” explained Lin Chen, Deribit’s Asia Business Development Head, in an interview with CoinDesk. This explains the substantial buildup in open interest for these out-of-the-money (OTM) calls.

The covered call strategy involves selling higher-level OTM calls while holding the underlying asset—in this case, XRP. This approach allows traders to capture the premium from selling or writing the call while limiting potential losses from an unexpected market rally.

This strategy not only generates additional yield on top of their holdings but is also popular in traditional markets as well as in bitcoin and ether trading.