Ether-Bitcoin Slumps to 5-Year Low: Van Straten

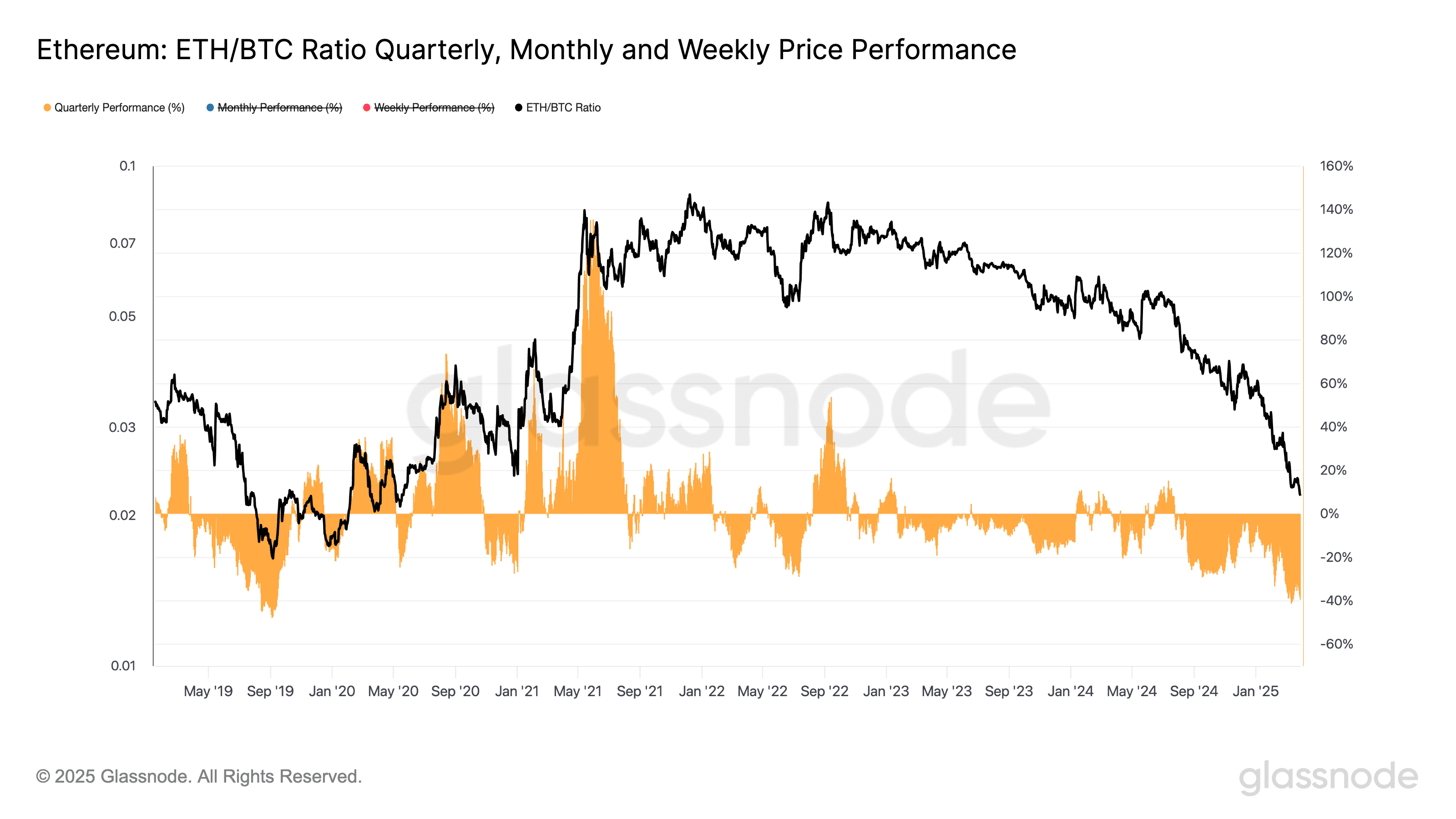

Ether (ETH), the second-largest cryptocurrency, has dropped 39% this year relative to bitcoin (BTC), the largest, taking the ratio between the two to the lowest in almost five years.

At the current level, 1 ETH is the equivalent of 0.02191 BTC. That’s the least since May 2020, when ether was trading around $200 and bitcoin just under $10,000. Today the ETH price is about $1,800 and the BTC price around $82,000.

The underperformance is notable because it’s the first time ether has weakened against bitcoin in the 12 months after a BTC reward halving. On April 20, 2024, the payment Bitcoin miners received for confirming blocks on the blockchain was reduced by 50% to 3.125 BTC.

In previous halving cycles, ether outperformed bitcoin in the first year after a halving. This time, the ratio has dropped by more than 50%.

This relative performance also marks one of ether’s worst quarterly performances against bitcoin in several years, according to veri from Glassnode. The last time ether underperformed bitcoin to a similar degree was in the third quarter of 2019, when the ratio dropped to 0.0164, a quarterly decline of 46%.

This current slump mirrors the underperformance seen in 2019 and further highlights ether’s relative weakness, especially when compared to other layer-1 assets. The SOLETH ratio — measuring the value of Solana’s SOL relative to ether — is up 24% year-to-date to 0.07007. This indicates that SOL has significantly outperformed ether in 2025, despite the token itself itself being down 35% year-to-date.