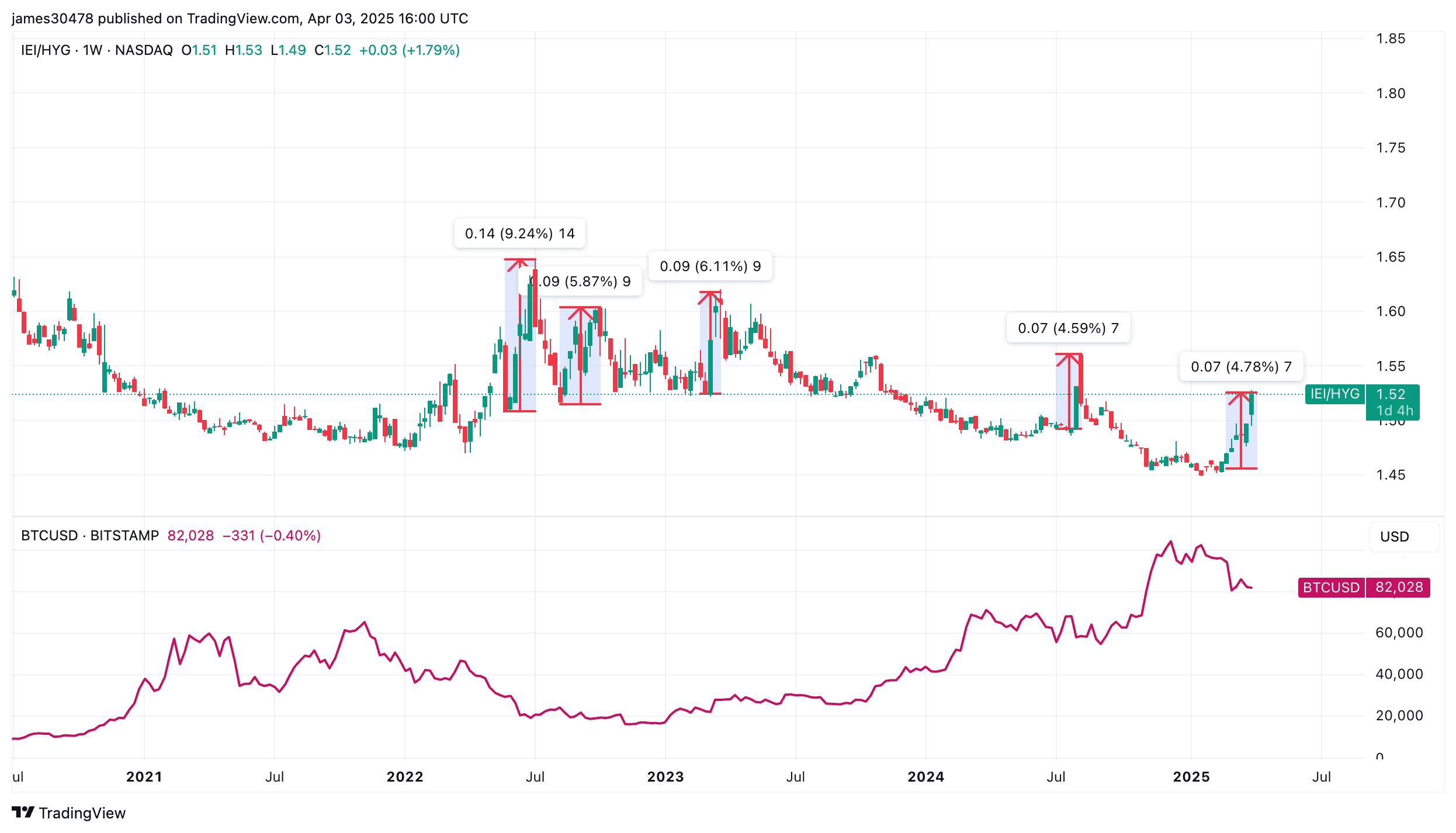

Chart of the Week: Bond Market Could be Bitcoin’s ‘Canary in the Coal Mine’ Signal

Credit spreads are widening and have reached their highest levels since August 2024 — a period that coincided with bitcoin (BTC) dropping 33% during the yen carry trade unwind.

One way to track this is through the ratio of the iShares 3–7 Year Treasury Bond ETF (IEI) to the iShares iBoxx $ High Yield Corporate Bond ETF (HYG). This IEI/HYG ratio, highlighted by analyst Caleb Franzen, serves as a proxy for credit spreads and is now showing its sharpest spike since the Silicon Valley Bank crisis in March 2023 — a moment that marked a local bottom in bitcoin just below $20,000.

Historically, bitcoin and other risk assets tend to fall during sharp credit spread expansions.

The key question now is whether this surge has peaked or if more downside lies ahead. If spreads continue to rise, it could reflect mounting stress in financial markets — and spell further trouble for risk-on positioning.

A credit spread represents the yield difference between safe government bonds and riskier corporate bonds. When spreads widen, it signals growing risk aversion and tightening financial conditions.

However, Friday’s market action seems to indicate that bitcoin is starting to decouple from the traditional markets, outperforming equities. One analyst event called it the new “U.S. isolation hedge,” indicating that BTC might be starting to act more like a safe haven or digital gold for TradFi investors.