Ripple, Solana, Cardano: How Will Trump Tariffs Impact Their Tokens?

Majors XRP, Solana (SOL), and Cardano (ADA) are each seeing a roughly 6% price slump in the past 24 hours amid broader macroeconomic pressures.

Recent market narratives show uncertainty around U.S. policies, including tariffs and a hawkish Federal Reserve stance with fewer expected rate cuts in 2025, providing the fundamental backdrop for a move further lower in crypto majors.

Here’s what technical analysis and price-action indicate for these tokens in the near term.

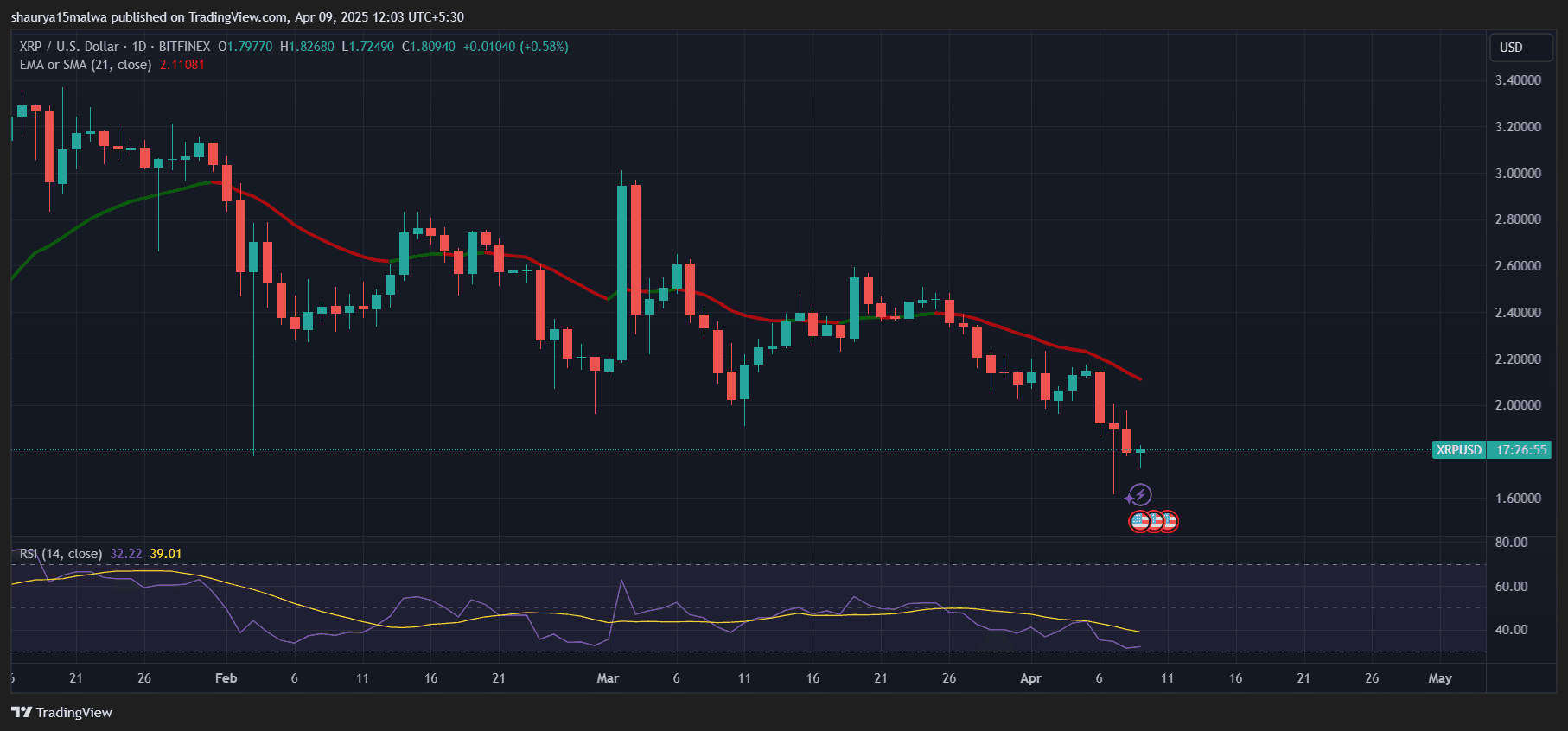

XRP Price Analysis

XRP, the token closely related to payments firm Ripple Labs, is below critical support levels with the next support threshold around the $1.60 mark. High leverage in XRP trading positions, as Coinglass veri shows, hints at potential for more downward pressure before any recovery.

- A potential double bottom pattern has formed near $1.80; the overall market structure remains bearish despite modest recovery attempts from the $1.60-$1.70 range.

- Technical indicators show deeply oversold conditions with RSI at 22.41, while the MACD and Chaikin Money Flow (-0.17) signal strong bearish momentum as money flows out of the asset.

- The 50% Fibonacci retracement level at $1.91 is currently acting as a pivotal point for a potential trend reversal in the near term.

- Price action shows a series of lower highs from the $2 support zone. A bullish divergence has formed on lower timeframes, suggesting stabilization. This will now act as a resistance level after previously being a critical support level.

- Momentum indicators have shifted from bearish to neutral in recent trading. RSI indicates oversold conditions, suggesting potential for a reversal if bullish momentum builds. The MACD shows a bearish crossover, reinforcing a downward bias unless a reversal signal emerges.

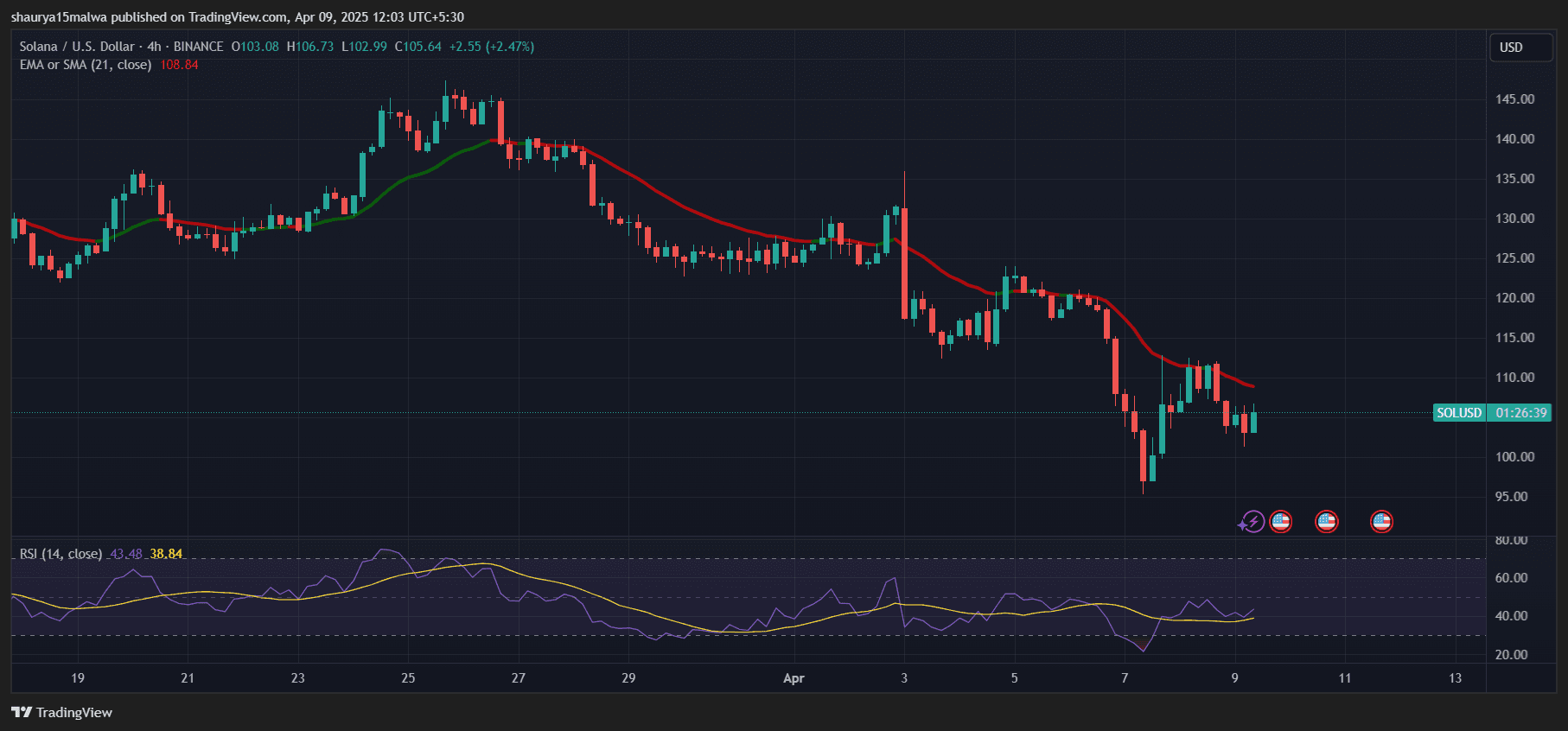

SOL Price Analysis

SOL is down over 8% in a week and in a crucial support zone between $100 and $110. The current slump suggests it may be revisiting these levels or even lower, with thin liquidity below $100 potentially leading to a sharper fall toward as low as $50.

- SOL experienced a dramatic 22% drop from $122.75 to $95.72 between April 5-7, with partial recovery establishing a new trading range between $103-$112.

- Major Solana whales unstaked and dumped significant holdings, with one transaction worth approximately $30 million coinciding with a $200 million token unlock event.

- Needs to reclaim $112 to target $120; failure could see a drop to $96. The RSI is consistently below 40, indicating strong bearish momentum and oversold conditions.

- MACD shows bearish crossovers, aligning with a downward trend. Price is below key moving averages ($130.5 and $184.2), reinforcing bearish bias.

- Technical structure suggests more downside risk unless $112 is reclaimed.

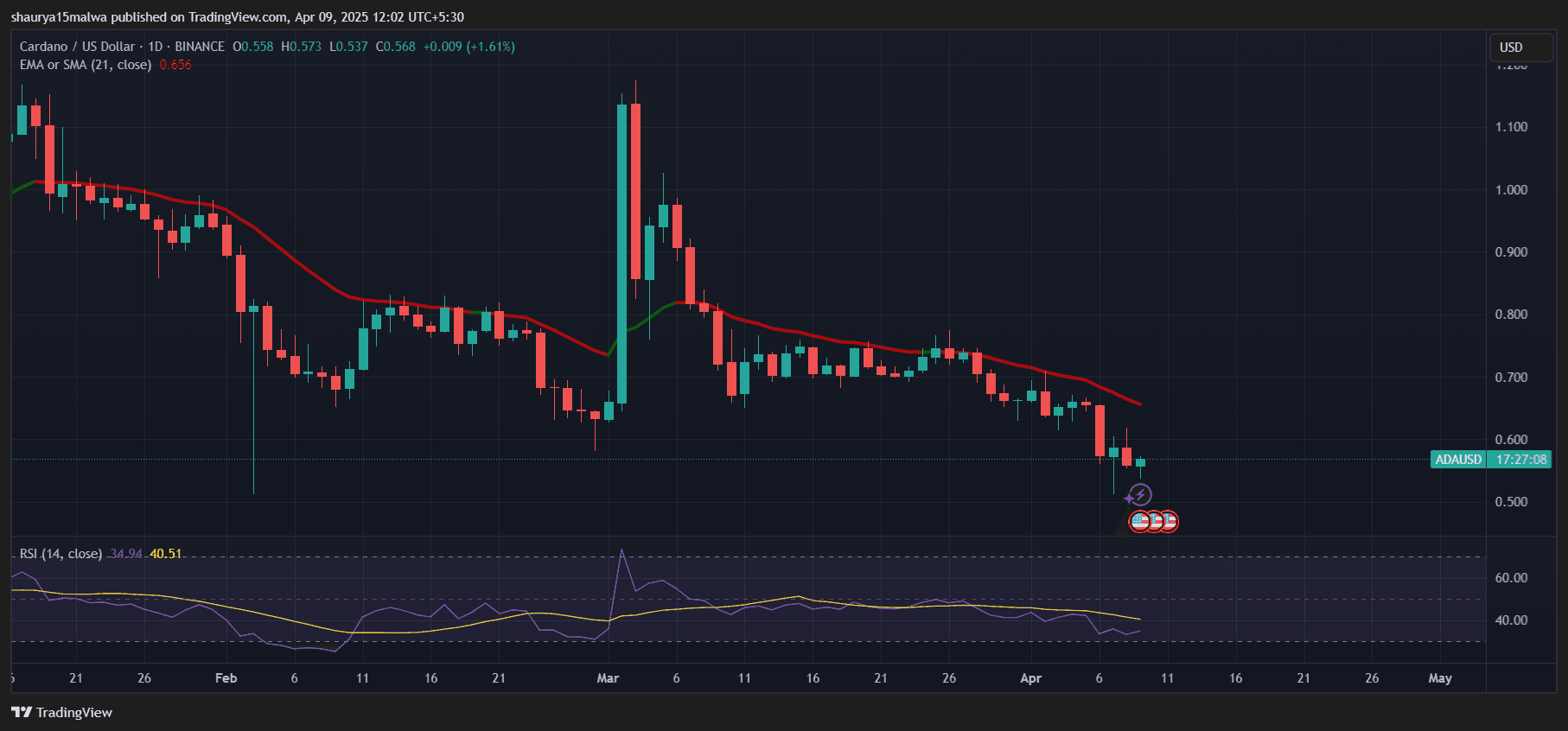

ADA Price Analysis

ADA has similarly declined by about 6% in the past 24 hours and down over 23% in the past two weeks.

- Daily RSI is at 32, suggesting ADA is nearing oversold territory (typically below 30) but still has room for further downside before a potential reversal. This indicates bearish momentum persists, though exhaustion may be nearing.

- ADA is trading below its 21-day moving averages on a daily timeframe, confirming a bearish trend.

- However, ADA is currently within a falling wedge pattern on the daily timeframe. This is typically a bullish reversal pattern, with a taban to 60 cents– 61 cents expected before a potential sharp upward reversal, possibly forming a bear trap.

Outlook

For XRP, watch $1.62 as a pivotal support; a break below could see it target $1 or lower, while a bounce might signal a short-term relief rally. SOL’s fate hinges on holding $100—failure here could accelerate losses, but oversold conditions might spark a rebound if macro pressures ease. ADA bulls needs to defend its current range to avoid a slide toward 55 cents.