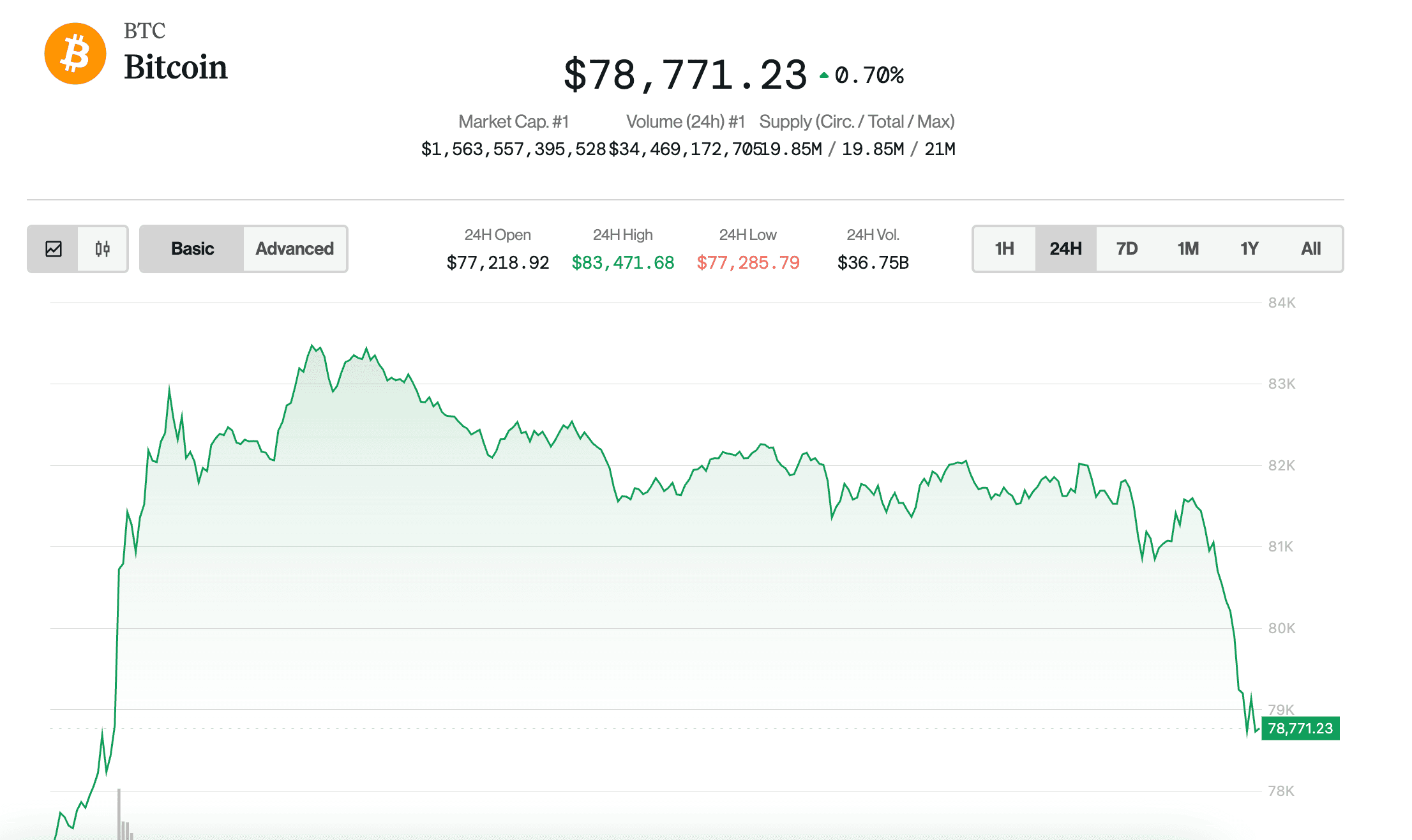

Bitcoin Tumbles Below $80K Alongside 5% Plunge in Nasdaq as China Tariff Tiff Escalates

After U.S. markets enjoyed a brief gasp of relief on Wednesday, charts got ugly again on Thursday as focus shifted to a potential bigger conflict between the U.S. and China.

Bitcoin (BTC), which rose more than 8% the day prior, dipped about 4% below $80,000 again on Thursday. The decline in bitcoin came alongside a renewed plunge in the Nasdaq, which was lower by 5.5% following yesterday’s 12% rally as traders are assessing U.S. President Donald Trump’s next steps in his tariff policy.

Crypto stocks also took a hit. MicroStrategy (MSTR) was down 11.2%, and Coinbase (COIN) and Marathon Digital (MARA) fell 8.1% and 9.3%, respectively.

Already sharply lower on the session, the stock sell-off escalated after a tweet circulated saying that a White House official confirmed that the total tariff rate on China now stands at 145%, not 125% as President Trump stated yesterday.

The Executive Order details that the “reciprocal” tariff rate surged from 84% to 125% overnight. When combined with the existing 20% tariff on fentanyl-related goods, the total rate reaches 145%.

China, in a bid to strike at Trump’s initial tariffs, said it would reduce imports of American movies, intensifying the trade war between the two countries.

Meanwhile, gold is soaring up 3% and hitting a new all-time high of $3,168. The DXY index, which measures the U.S. dollar against a basket of foreign currencies, has dropped below 101, effectively reversing its entire November rally, and now down 9% from the January highs.

Politically charged environment

“The macro outlook is anything but secure,” said Kirill Kretov, senior expert at crypto trading automation platform CoinPanel. “This is a politically charged environment, where headlines have the power to reshape sentiment almost instantly.”

“A key swing factor now is trade policy,” Kretov added, with the Trump administration’s ever-changing tariff policies adding to concerns about inflation. “Any escalation on this front would complicate the Fed’s decision-making and potentially derail the current market narrative,” he said.