Can Bitcoin Benefit From Trump Firing Powell? Turkey’s Lira Crisis May Provide Clues

The week has begun on an interesting note, with the U.S. dollar crashing to three-year lows alongside losses on Wall Street, yet bitcoin, which usually follows the sentiment on Wall Street, stands tall.

This could just be the beginning.

The shift away from the USD and toward seizure and censorship-resistant assets like BTC and stablecoins could accelerate if President Donald Trump follows through with his reported plans to fire Federal Reserve Chairman Jerome Powell, which have pushed the DXY and U.S. stock markets lower today.

That’s the lesson from Turkey, which has seen its currency, the lira (TRY), collapse over the years mainly due to President Recep Tayyip Erdogan’s repeated interference in the central bank’s operations. The sliding lira has triggered a capital flight into BTC and stablecoins since at least 2020-21.

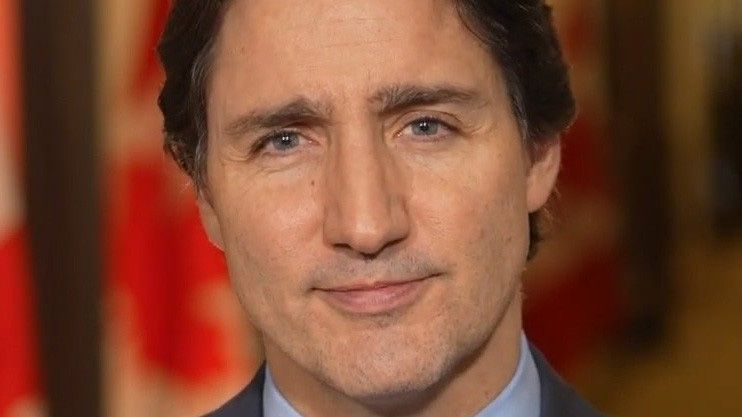

Trump’s issues with the Fed

Trump has feuded publicly with the Federal Reserve and its chairman, Jerome Powell, for years, criticizing Powell for being too late on rate cuts even during his first term when interest rates were way lower than today.

However, Trump’s criticism has recently reached a fever pitch with reports suggesting he is looking for ways to get rid of Powell, who recently warned of stagflation even as the President reiterated calls for lower borrowing costs while suggesting there is no inflation.

Powell’s patient approach follows a trade war-led spike in survey-based measures of inflation expectations, which could always become self-fulfilling.

Still, on Monday, Trump went further, calling Powell a “major loser” and warning that the economy could slow down unless interest rates are immediately lowered.

Lesson From Turkey

Erdogan began interfering in the central bank’s operations in 2019, and since then, the lira has collapsed sevenfold from 5.3 per dollar to 38 per dollar.

It all started with Turkey’s inflation rate reaching double digits in 2017. It remained elevated in the subsequent year, which prompted the country’s central bank to increase the one-week repo rate from 17.5% to 24% in September 2018.

The move likely didn’t go well with Erodgan, who issued the first decree dismissing Central Bank of Turkey (CBT) governor Murat Cetinkaya in July 2019. From then on until the end of 2021, Erdogan issued multiple decrees dismissing and hiring several CBT officials. Amid all this, inflation remained elevated, and the lira continued to depreciate at an alarming rate.

“We certainly don’t believe in high interest rates. We will pull down inflation and exchange rates with low-rate policy … High rates make the rich richer, the poor poorer. We won’t let that happen,” Erdogan said in 2021.

As of 2025, Turkey faces an inflation rate of nearly 40%, according to veri source TradingEconomics.

This episode serves as a cautionary tale for Trump, highlighting that tampering with central bank independence — especially in the face of looming inflation — can erode investor confidence and send the domestic currency into a tailspin.

This does not necessarily mean that the USD will crash exactly like lira but may see significant devaluation.

Perhaps it could prove even more destabilizing for küresel markets, considering the dollar is a küresel reserve currency, and the U.S. Treasury market is the bedrock for international finance.

If better sense fails to prevail, U.S. investors may feel incentivized to move away from U.S. assets and into BTC and other alternative investments, just as Turks did.