Trading in financial markets feels like dodging a barrage of stones, each demanding constant vigilance and agility. Just as bitcoin (BTC) and traditional risk assets stabilize after last week’s Trump tariff-led panic, unsettling movements in Japanese …

Story Protocol’s IP tokens slumped 20% and retraced the entire move within hours late Monday in an unusual trading session. IP fell from nearly $4 to $3.27 in a four-hour period, jumping back to over $4 in a couple of hours after hitting the daily …

Dogecoin shed 3% while bitcoin (BTC) and ether (ETH) remained flat in the past 24 hours as tariff concerns gradually subsided among traders, though fears of a U.S. recession increased in betting markets. “Prominent financial figures have started to …

Bitcoin (BTC) drifted ever so gently upwards Monday as the broader market adjusts favorably to trade-related news. The largest cryptocurrency was up 1.6% in the last 24 hours and is now trading just shy of $85,000. Ether (ETH), meanwhile, rose 2.7 …

The Securities and Exchange Commission (SEC) is not yet ready to make a decision on two critical features that issuers of the spot crypto exchange-traded funds (ETFs) are hoping to add to their products. The regulator delayed a decision on whether it …

Circle’s euro-backed stablecoin, EURC, surged to a record supply as mounting U.S. trade tensions and a weakening dollar likely fuel demand for euro-denominated digital assets. EURC’s supply grew 43% over the past month to 217 million tokens worth …

South Korean regulators requested 14 apps from Apple — belonging to unreported foreign crypto operators — be blocked domestically, a statement said on Monday. Crypto exchanges KuCoin and MEXC are among the firms being targeted by the regulator, and …

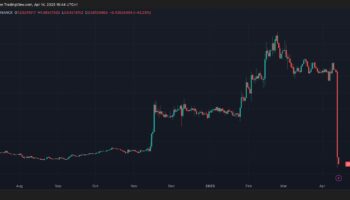

Switzerland-based trading firm Laser Digital, which is part of the Nomura Group, has denied any involvement in the Mantra token flash crash that saw OM lose lose 90% of its value. “Assertions circulating on social media that link Laser to …

Nvidia plans to manufacture its next generation of AI chips and supercomputers entirely in the U.S. for the first time, the company said in a statement on Monday. The move reflects rising demand for AI infrastructure and a broader push to localize …

Crypto exchange Kraken has begun offering commission-free trading for U.S.-listed stocks and exchange-traded funds (ETFs), opening access to traditional financial markets from within the same platform it uses for cryptocurrencies and positioning …