Analysts expect a 0.25% rate cut this week, which has historically benefited assets like BTC by diluting the dollar’s value and pushing investors towards alternative investments.

Crypto exchange Coinbase’s shares closed the day 31% higher, leading gains among digital asset-related stocks.

The blockchain industry might get a boost as former U.S. President Donald Trump wins a second term, promising to keep his promises, including a long list of Bitcoin- and crypto-related pledges.

Quinn Thompson, the founder of crypto hedge fund Lekker Capital, shared with CoinDesk why he was so confident Donald Trump would win the U.S. presidential election despite the polls.

Analysts expect a broad market rally and changes in SEC leadership. Trump’s crypto policies include a bitcoin strategic reserve, banning a central bank digital currency and freeing Ross Ulbricht.

The banking giant was one of the early leaders in applying blockchain tech to traditional financial activities, executing over $1.5 trillion of transactions since its inception.

The $3.6 billion contract closed Wednesday morning as the Associated Press, Fox and NBC declared the election for Republican candidate Donald Trump.

While sell-the-fact price slide looks unlikely, traders still need to watch out for the other side of the Trump trade – hardening bond yields and rising dollar index, says CoinDesk analyst Omkar Godbole.

Stablecoin and market structure bills may now both see faster progress, the report said.

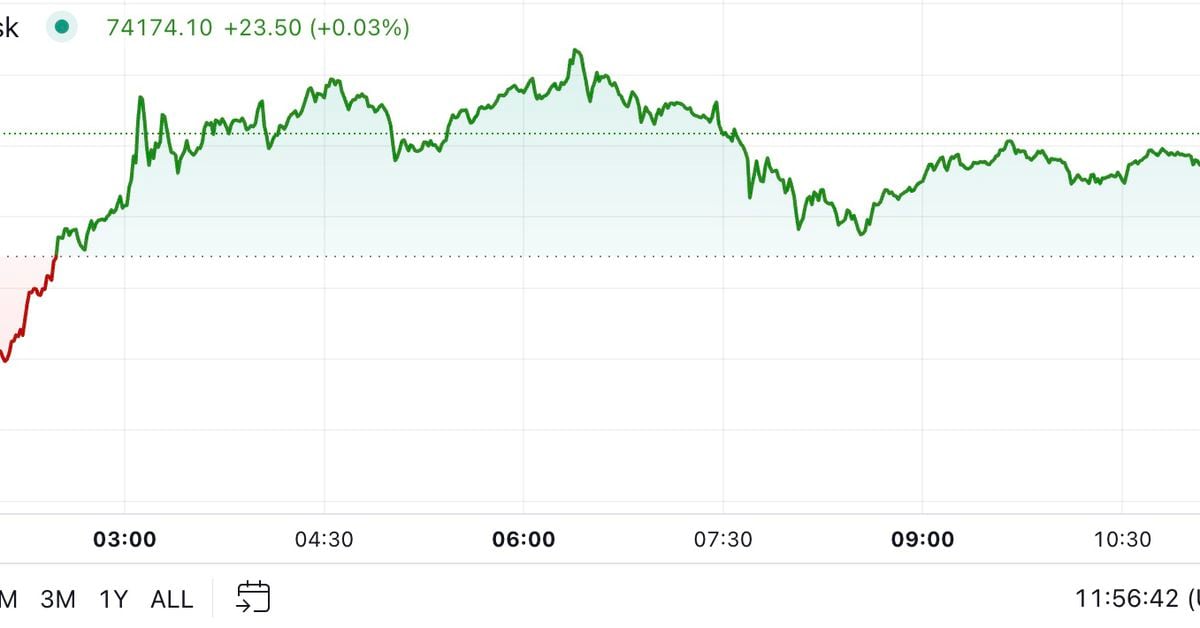

The latest price moves in crypto markets in context for Nov. 6, 2024.