Bitcoin

The last hurdle for MSTR to qualify for the S&P 500 is to achieve positive GAAP net income over the trailing 12 months.

The state’s investment board’s stake was worth more than $320 million as of the end of 2024.

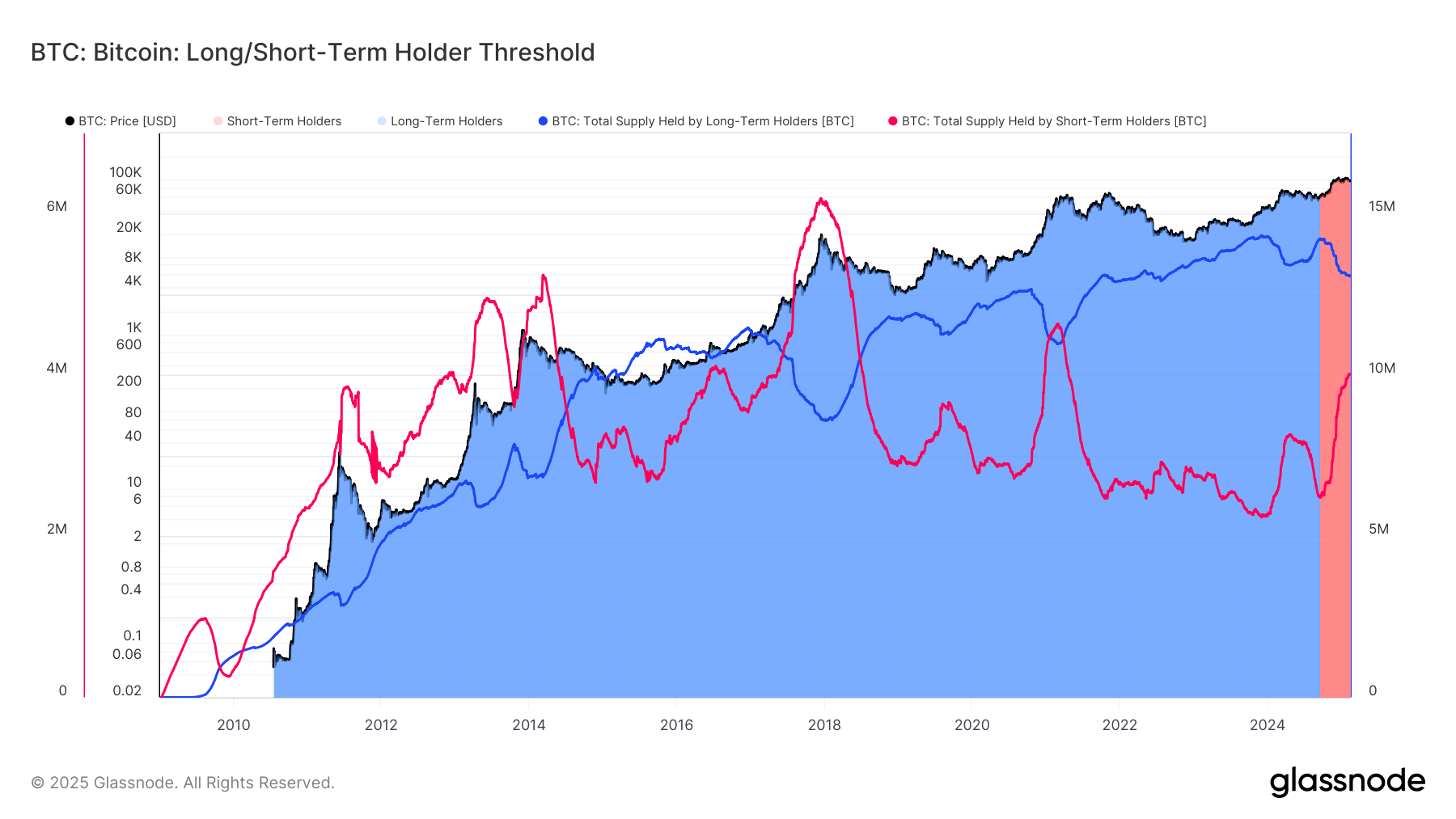

Since September, short-term holders have accumulated over 1.5 million bitcoin.

The Semler Scientific chair introduced the first member of his ‘Zombie Zone’ companies that could benefit from adding bitcoin to their balance sheet.

The project, which also claims Tether’s Paolo Ardoino as an investor, aims to enhance stablecoin adoption through a Bitcoin sidechain that allows zero-fee USDT transactions.

Bitcoin continues to trade in a range that it has set since mid-November.

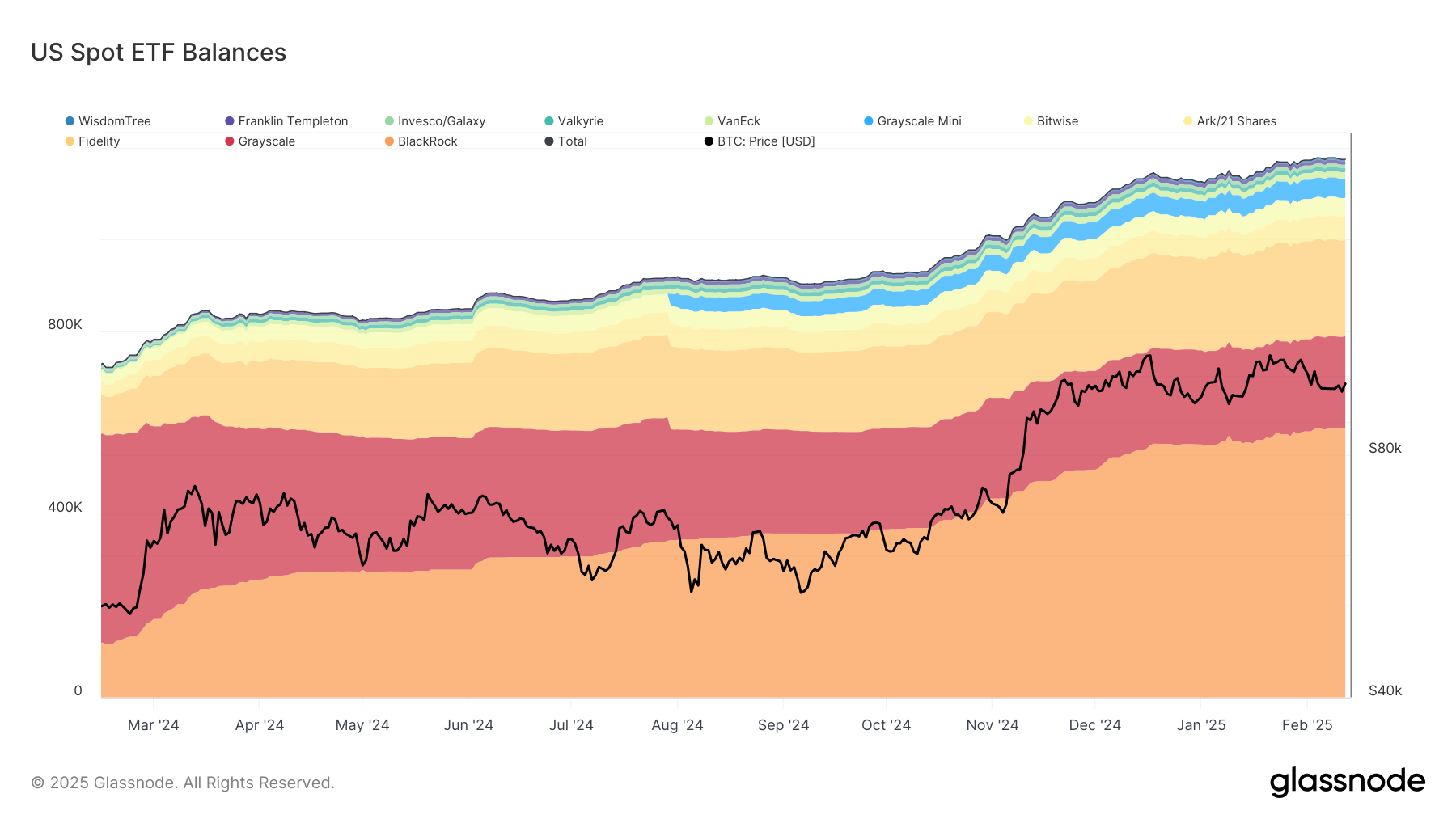

The bank’s clients are likely involved in the basis trade, rather than making a directional bet, said an analyst.

Company strengthens bitcoin treasury strategy with $10 million purchase, emphasizing BTC yield as key performance indicator.

The CME has not yet listed ADA futures, which is widely considered a prerequisite for gaining approval for a spot ETF

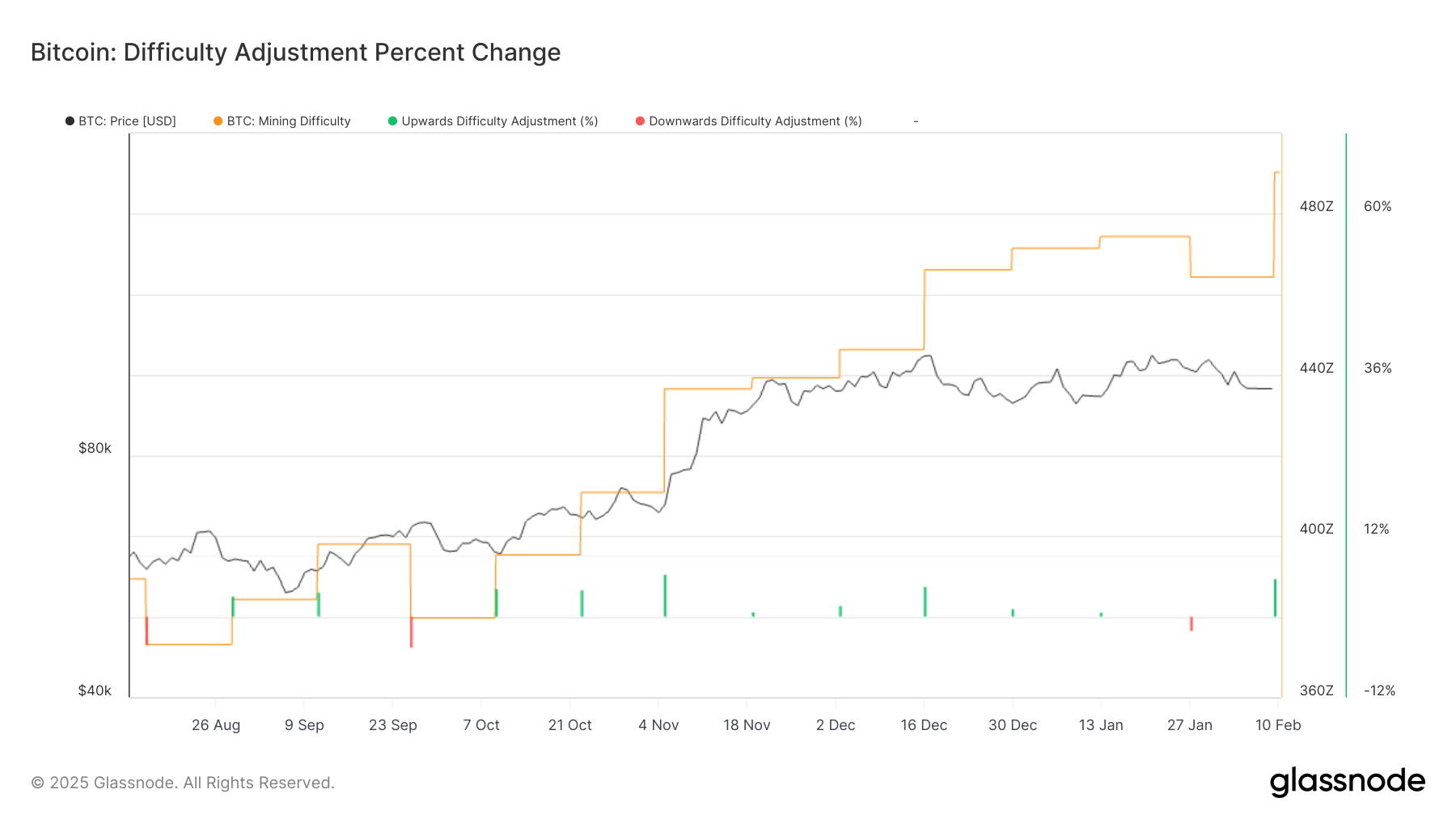

Hash Ribbon signals miner capitulation, which tends to mark a local bottom in the bitcoin price.