Crypto

The company says the commission will vote on a deal negotiated by staff to abandon the enforcement case at the core of the agency’s previous crypto stance.

More tokens could be added to exchanges, increasing their trading revenue. This might also open the floodgates to crypto firms’ IPOs in the U.S.

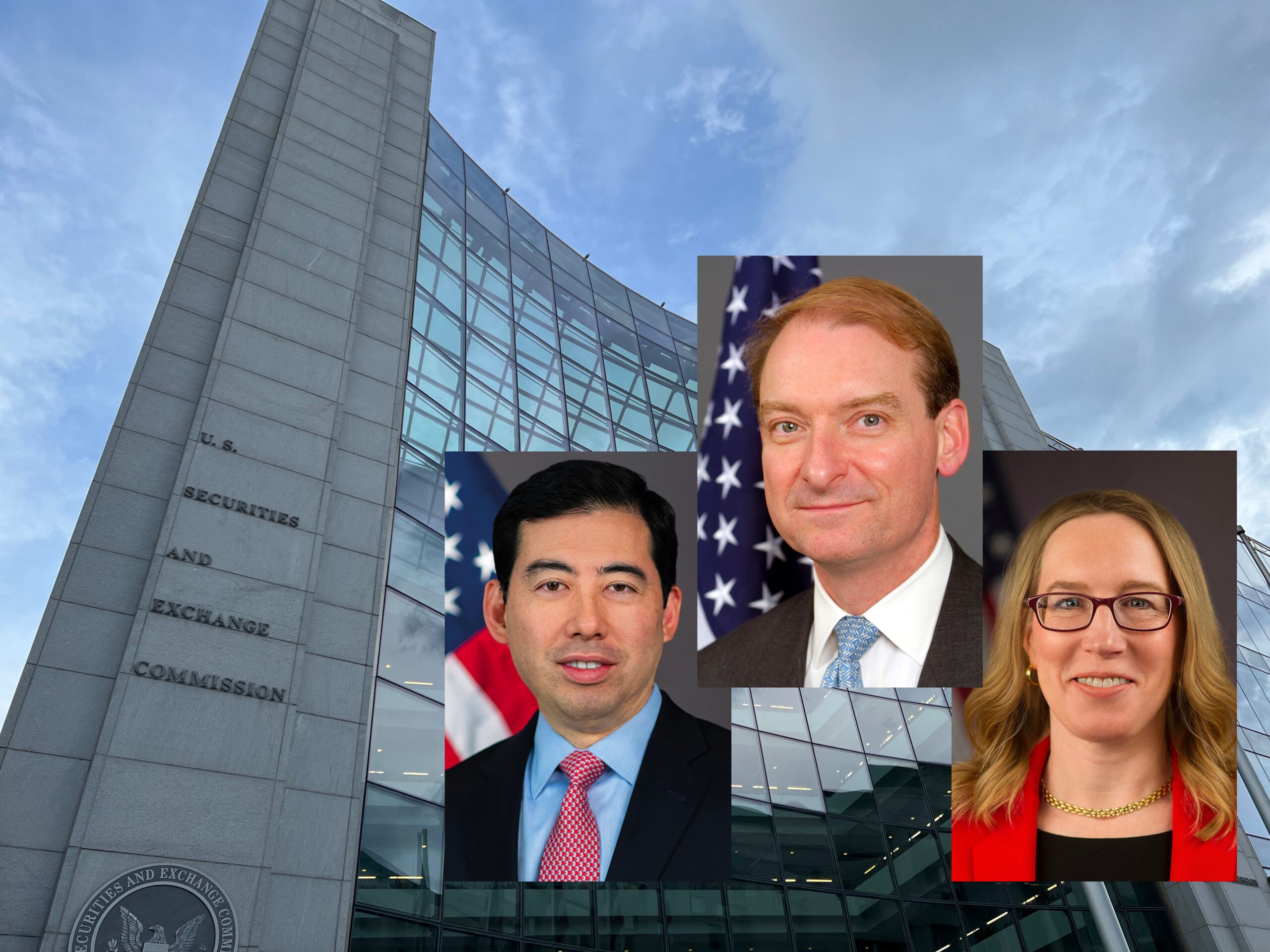

The SEC’s Republican leaders have shifted what had been a crypto-focused enforcement squad into a smaller group with a broader responsibility.

Shifting U.S. policy is driving banks and investors deeper into crypto markets, cementing long-term positions.

The U.S. Securities and Exchange Commission has been overhauling its digital asset kanunî strategy, and this week it dropped an appeal of the crypto dealer rule.

Also: Ethereum developers release “Open Intents Framework,’ Monad & Orderly Join Forces, and Crypto’s Most Influential Investor?

The approval allows the trading platform to expand its digital asset offerings across all 30 European Economic Area countries.

A survey by the crypto exchange showed that 85% of digital asset holders in the U.S. invested in memecoins.

A new report from the analytics firm says that sanctioned jurisdictions and groups were responsible for 39% of illicit crypto transactions last year.

“What is stopping [crypto] from going mainstream is really that consumers need to be able to find each other using what they already know,” Mastercard’s head of crypto and blockchain, Raj Dhamodharan told CoinDesk.