Futures

CME’s bitcoin futures, considered a proxy for institutional activity, gapped lower Monday in a sign of bearish sentiment after President Donald Trump ruled out a trade deal with China. The futures contract due to expire on the last Friday of April …

U.S. crypto giant Coinbase Institutional said on Friday it had submitted a filing to the Commodity Futures Trading Commission (CFTC) to roll out futures contracts tied to Ripple’s closely related XRP token. “We’re excited to announce that …

CME Group (CME) saw record activity in its cryptocurrency derivatives markets during the first quarter of the year, driven by increased interest in micro-sized contracts. The company reported average daily volume of 198,000 contracts for crypto …

CME Group expands its crypto offerings with Solana futures, set to debut in March.

On Monday, U.S. spot-listed bitcoin ETF outflows rose to $516 million as bitcoin tumbled toward $90,000.

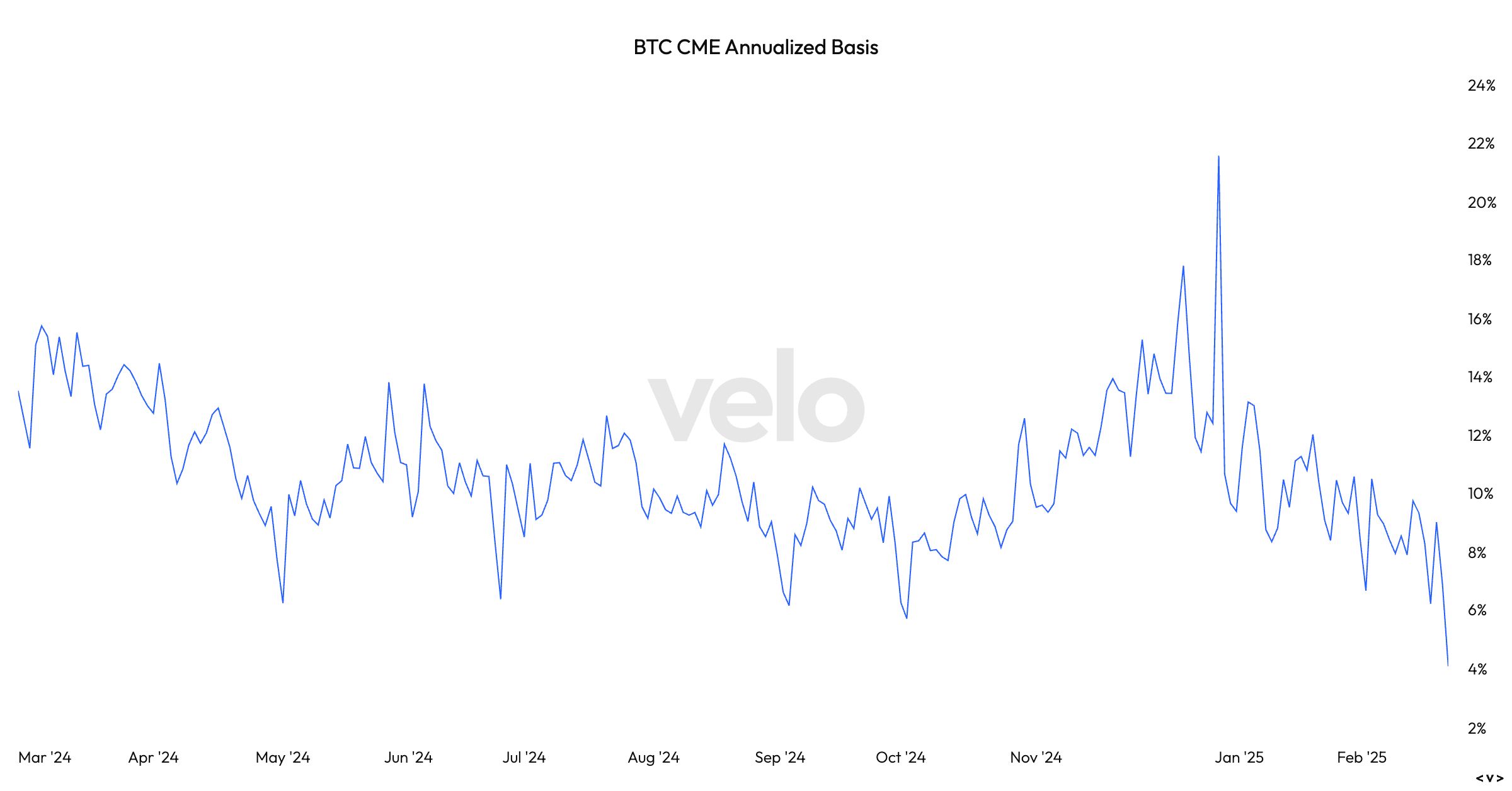

Institutional crypto futures positioning suggests a weakness in demand, the report said.

The record short interest is led by carry trades and some amount of outright bearish bets on the second-largest cryptocurrency.

Coinbase is looking to list the futures as soon as Feb. 18, it said in the filing.

A tracker for market sentiment reached “extreme greed” levels on Thursday, which has historically preceded market corrections.