High

The Cosmos ecosystem is gaining significant institutional attention amid broader market volatility, with ATOM showing remarkable resilience after recovering from a drop to $4.23 on April 30th to stabilize above $4.38. The price of ATOM rose more …

Avalanche’s AVAX token has broken out of its multi-week correction phase, demonstrating remarkable strength despite ongoing geopolitical tensions affecting cryptocurrency markets. The broader market gauge, CoinDesk 20 Index(DLCS), has demonstrated …

Disclaimer: The analyst who wrote this piece owns shares of Strategy (MSTR). From April 2024 to April 2025, investors in Strategy (MSTR) and the YieldMax MSTR Option Income Strategy ETF (MSTY) followed two distinctly different investment paths — one …

The number one question on investors’ minds is whether an asset has hit its bottom after being in a sustained downtrend for an extended period of time. Recent price action suggests that bitcoin (BTC) may have found its bottom just above $76,000 on …

Futures tracking ADA, XRP and SOL registered over $70 million in liquidations each, their highest such levels since September 2024, Coinglass veri shows.

BTC takes a breather as Trump’s tariff threat bodes well for gold, and the uptick in Tokyo inflation supports BOJ rate hikes.

Sustained demand for Layer 2s could quickly deplete the available blob capacity. The impending Pectra upgrade only kicks the can down the road, Polynomial’s co-founder said.

Whale transactions and large withdrawals from exchange signal demand for the largest memecoin by market capitalization.

The candlestick pattern shows sellers are looking to reassert themselves as hawkish Fed rate projections drive the DXY higher.

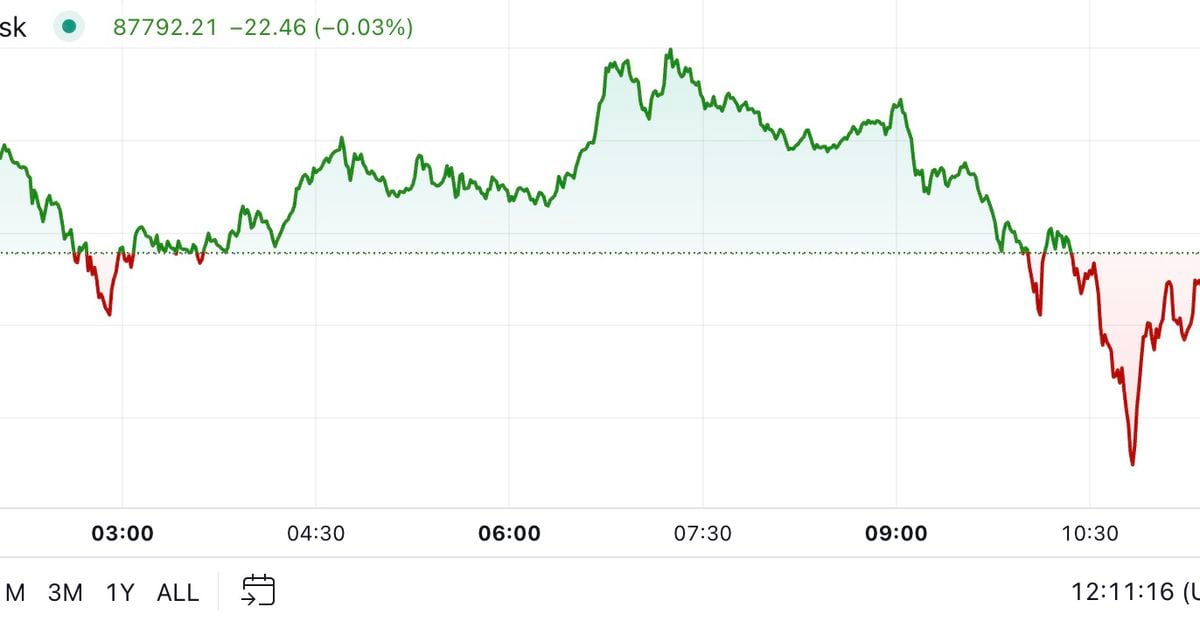

The latest price moves in crypto markets in context for Nov. 12, 2024.