Over

A notable 65% of the survey respondents are bullish long-term, with 63% mulling more allocation to digital assets in the next three to six months.

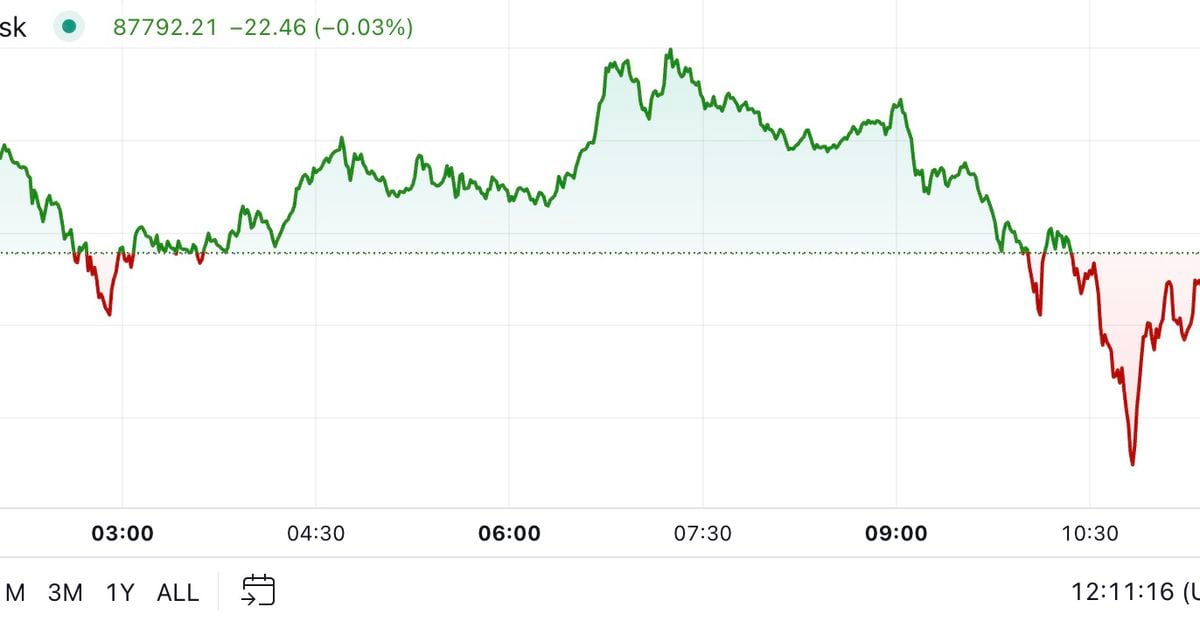

The latest price moves in crypto markets in context for Nov. 12, 2024.

Much of the current rally has been fueled by bullish sentiment around the meme’s endorsement by technology entrepreneur Elon Musk in the Trump administration.

Such cumulative losses are the highest since early April, when BTC briefly crossed its previous peak at over $73,000.

Weekend pumps are considered bullish because they indicate broad interest and participation from smaller investors rather than just institutional players.

“There is going to be a media frenzy about Elon and how his aggressively backing Trump and the ‘Department of Government Efficiency’ narrative could have been a deciding factor for a Trump win,” one trader said.

Part of BTC’s spike could be attributed to a $94 million liquidation of bearish or hedged bets against the asset, Coinglass veri shows, as Trump leads in early voting.

A tracker for market sentiment reached “extreme greed” levels on Thursday, which has historically preceded market corrections.